child tax credit 2021 dates november

IRSnews IRSnews November 7 2021 An income increase in 2021 to an amount above the 75000 150000 threshold could lower a households Child Tax Credit. It noted that it will keep its Free File program open through November 17.

Child Tax Credit 2021 Payments How Much Dates And Opting Out Cbs News

Max refund is guaranteed and 100 accurate.

. Those who miss the deadline can still claim the credit of up to 3600 per child if they file a 2021 tax return next year. Some families should expect a. Have been a US.

Child tax credit payments set to go out Monday. Ad Over 27000 video lessons and other resources youre guaranteed to find what you need. November 12 2021 926 AM CBS Los Angeles.

Taxpayers in North and South Carolina impacted by Hurricane Ian qualify for extended tax due dates. 15 opt out by. Ad Non-partisan not-for-profit resource for US data statistics on a variety of topics.

Free means free and IRS e-file is included. Guaranteed maximum tax refund. 15 opt out by Aug.

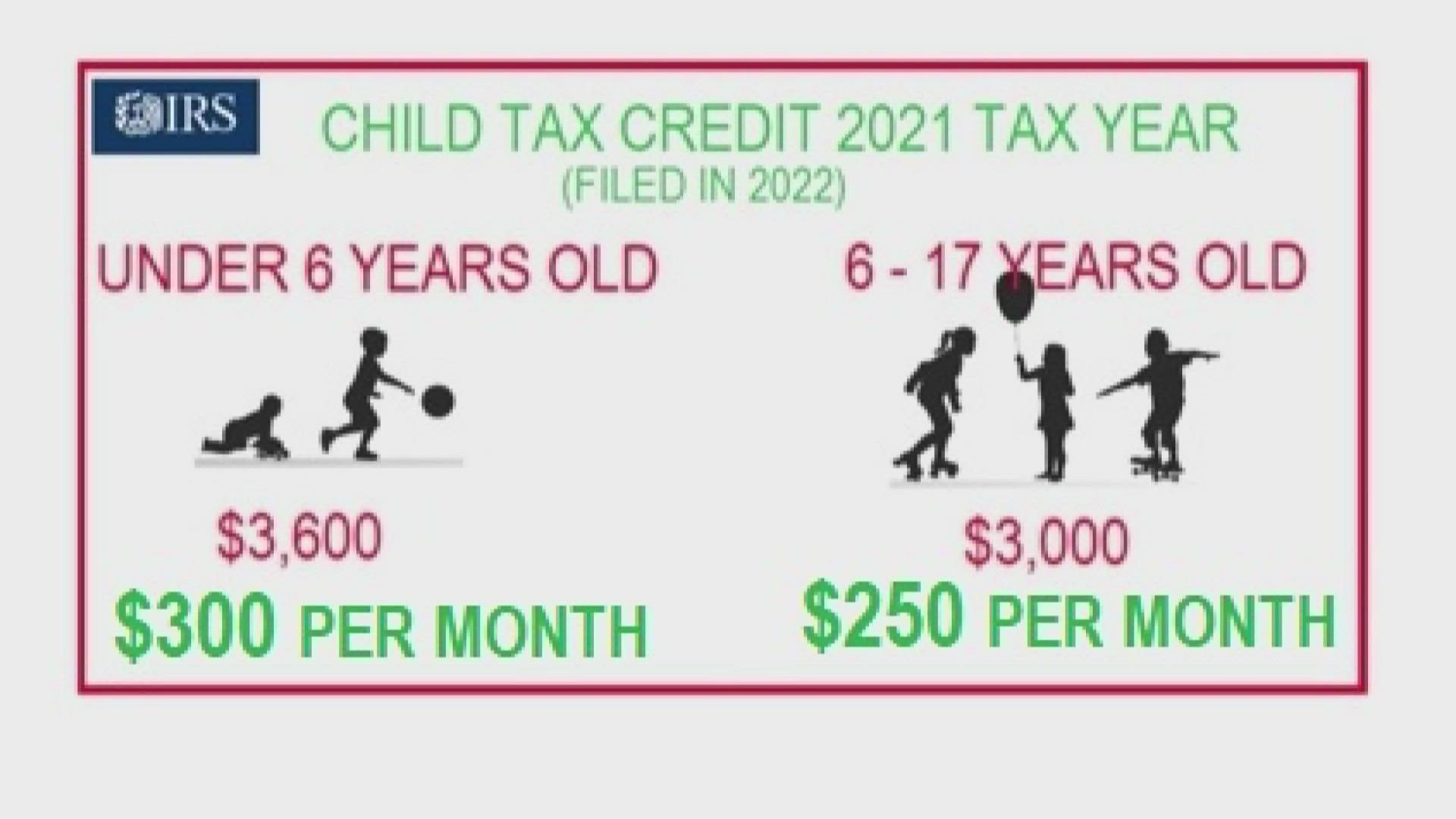

Ad Free tax filing for simple and complex returns. The 2021 child tax credit payment. By declining the monthly advance payments of Child Tax Credit CTC parents who are eligible can claim the full 2021 Child Tax Credit up to 3600 for a child under 6 and up to 3000 for a child 6 - 17 when they file their 2021 taxes in 2022.

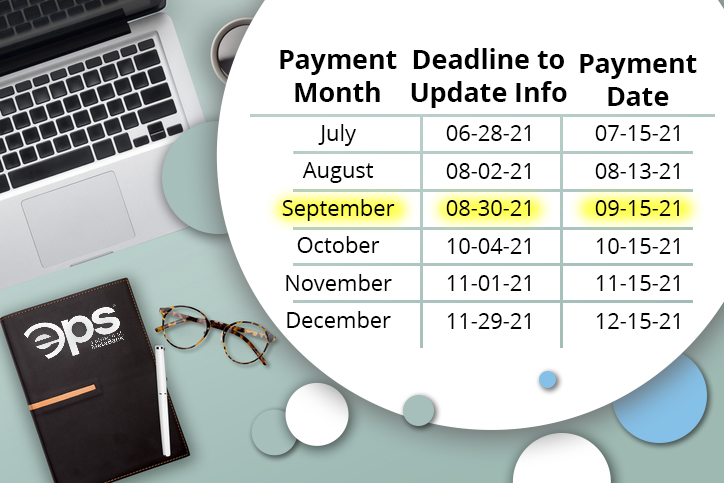

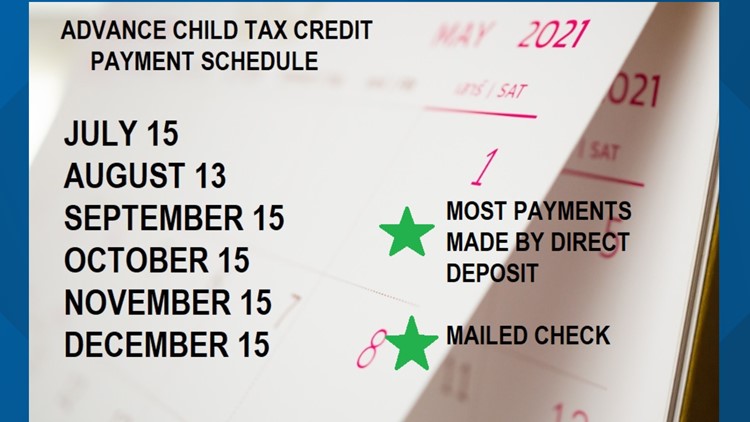

See what makes us different. The 2021 child tax credit payment dates along with the deadlines to opt out are as follows. We dont make judgments or prescribe specific policies.

The American Rescue Plan significantly increased the amount of Child Tax Credit a family could receive for 2021 typically from 2000 to 3000 or 3600 per qualifying child. You qualify for the full amount of the 2021 Child Tax Credit for each qualifying child if you meet all eligibility factors and your annual income is not more than. 13 opt out by Aug.

November 12 2021 1126 AM CBS Chicago CBS Baltimore -- The fifth Child Tax Credit payment from the Internal Revenue Service IRS will be sent this coming Monday. The 2021 child tax credit payment dates along with the deadlines to opt out are as follows. Schedule of 2021 Monthly Child Tax Credit Payments.

150000 if you are married and filing a joint return or if. 15 opt out by Oct. 1200 in April 2020.

322271627 pdf 322271627 pdfTitle. The enhanced child tax credit which was created as part of. Tax Identification IDFebruary 2021 PP-9 followed by Regulation Number 18PMK032021.

15 opt out by Nov. The Child Tax Credit was to be expanded for five years until 2025 but now the end of 2022 will be the deadline. It also made the parents or guardians of 17-year-old children newly eligible for.

The payments go out on the 15th of each month except on weekends so the November payment will come Monday. The final payment for the year will arrive Dec. Could be next-to-last unless Congress acts It could be extended through 2022 under Democrats 175 trillion social spending package.

For 2021 only the child tax credit amount was increased from 2000 for each child age 16 or younger to 3600 per child for kids. In the pattern attribute of an input tag I am using the following regular expression for validation of the US Federal Tax ID field. The CTC advanced monthly payments.

Canada child benefit payment dates. Benefit payment dates Canada child benefit CCB Includes related provincial and territorial programs All payment dates January 20 2022 February 18 2022 March 18 2022 April 20 2022 May 20 2022 June 20 2022 July 20 2022 August 19 2022 September 20 2022. Tax id a-20014452 company.

This measure was to coax the vote of Senator Joe Manchin a moderate who has been.

Late Child Tax Credit Payments From Irs Arriving Now Fingerlakes1 Com

2021 Child Tax Credit Advanced Payment Option Tas

How To Claim Your Child Tax Credit Before Monday S Deadline

Maria Cervantes Mc S Tax Financial Group You Are Not Required To Receive Monthly Child Tax Credit Payments This Year Instead You Can Choose To Get A Payment In 2022 And The New

Child Tax Credit Did Not Come Today Issue Delaying Some Payments Kare11 Com

Income Update Feature Debuts Nov 1 On Irs Child Tax Credit Portal Don T Mess With Taxes

After Child Tax Credit Payments Begin Many More Families Have Enough To Eat Center On Budget And Policy Priorities

Monthly Payments For Families With Kids The 2021 Child Tax Credit United For Brownsville

Don T Miss Out On The Expanded Child Tax Credit Advocates For Ohio S Future

Irs Investigating Why Some Families Didn T Receive September Child Tax Credit

November 15 2021 Deadline For Non Tax Filing Families To Use Child Tax Credit Portal Lone Star Legal Aid

Parents Are Getting Another Monthly Child Tax Credit Payment This Month Here S What To Know

Dependent Children 2021 Tax Credit Jnba Financial Advisors

Child Tax Credit 2021 Update November Stimulus Check Payment Date Is Next Week Ahead Of Final 300 Deadline The Us Sun

Haven T Received Your Advance Payment Of The Child Tax Credit Issued To You Yet

Eps Powered By Pathward The Child Tax Credit Payments Pros And Cons To Think About

Child Tax Credit Payment Begin In One Month July 15 Wfmynews2 Com

House Bill Makes Child Tax Credit Fully Refundable A Boon For Low Earners

Child Tax Credit November Payment Is Second From Last What To Know